Picture this: you’re running a store, and every day, new items arrive to replenish your stock. How do you determine the value of your inventory when it’s time to file taxes or make financial reports? That’s where inventory accounting methods come into play. In this article, we’ll dive into the basics of two popular methods: LIFO (Last-In, First-Out) and FIFO (First-In, First-Out). We’ll explore how they work, their advantages and disadvantages, and help you understand how to choose the right method for your business. So, grab your calculators and let’s unravel the secrets of inventory accounting!

- Mastering Inventory Management with LIFO and FIFO

*FIFO vs. LIFO differences, examples, and formulas for 2024 *

Best Software for Emergency Recovery Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. LIFO: Tax Treatment of Inventory | Tax Foundation. Oct 12, 2022 In this simplified example, assume inventory is the company’s only cost. If the company uses the FIFO inventory accounting method, it would , FIFO vs. LIFO differences, examples, and formulas for 2024 , FIFO vs. LIFO differences, examples, and formulas for 2024

- The Role of Inventory Accounting in Accurate Financial Reporting

Understanding Inventory Valuation Methods

FIFO vs LIFO: Comparing Inventory Valuation Methods. Best Software for Crisis Recovery Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. Discover the differences between FIFO vs LIFO inventory methods and optimize your inventory management strategy for maximum efficiency and profitability., Understanding Inventory Valuation Methods, Understanding Inventory Valuation Methods

- Unveiling the Secrets of FIFO and LIFO: A Comparative Analysis

*FIFO vs. LIFO: Choosing the Best Inventory Valuation for Your *

Inventory Management Methods: FIFO vs. LIFO. Jan 5, 2024 LIFO: What Is the Difference? Learn which inventory valuation method will boost your profits and lower your tax burden. author image. Best Software for Emergency Relief Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. Written by , FIFO vs. LIFO: Choosing the Best Inventory Valuation for Your , FIFO vs. LIFO: Choosing the Best Inventory Valuation for Your

- LIFO vs. FIFO: Navigating the Future of Inventory Accounting

FIFO Method for Valuating Your Inventory (Oh, and LIFO too!)

FIFO vs LIFO: A Guide to Inventory Cost Flow | Pallite Group. International Use of FIFO vs LIFO; Implementing and Switching Methods. Let’s start with the basics of defining FIFO and LIFO inventory valuation. The Rise of Game Esports InVision Users Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. Defining FIFO , FIFO Method for Valuating Your Inventory (Oh, and LIFO too!), FIFO Method for Valuating Your Inventory (Oh, and LIFO too!)

- Maximizing Inventory Accuracy with LIFO and FIFO

Inventory Valuation Methods: A Comprehensive Guide

FIFO vs. LIFO Inventory Valuation. Top Apps for Task Management Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. Nov 20, 2024 Inventory can be valued using a few different accounting methods, including first In, first out (FIFO) and last in, first out (LIFO)., Inventory Valuation Methods: A Comprehensive Guide, Inventory Valuation Methods: A Comprehensive Guide

- Expert Insights: Delving into the Fundamentals of LIFO and FIFO

Inventory Valuation Methods: A Comprehensive Guide

FIFO and LIFO accounting - Wikipedia. Best Software for Emergency Mitigation Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. FIFO and LIFO accounting are methods used in managing inventory and financial matters involving the amount of money a company has to have tied up within , Inventory Valuation Methods: A Comprehensive Guide, Inventory Valuation Methods: A Comprehensive Guide

Basics Of Lifo And Fifo Inventory Accounting Methods vs Alternatives: Detailed Comparison

FIFO Method Accounting | Double Entry Bookkeeping

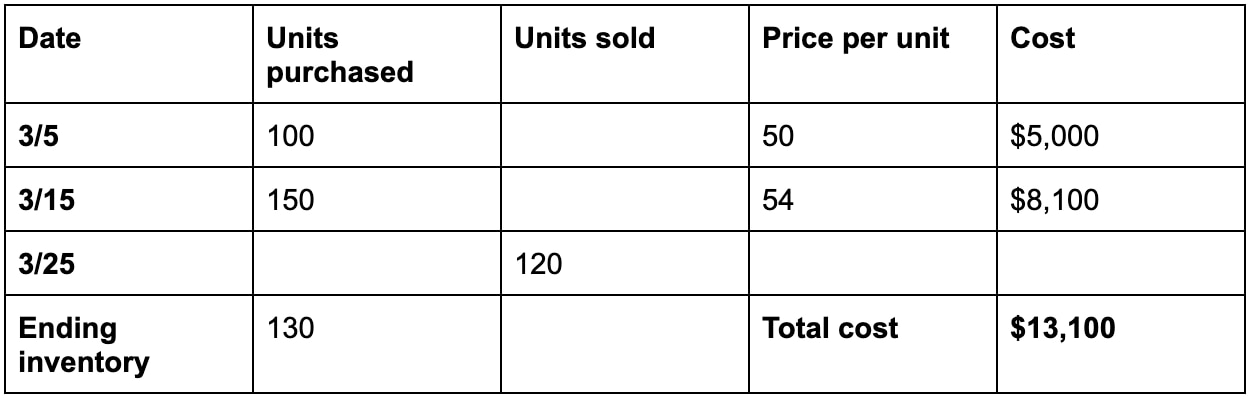

FIFO vs. LIFO differences, examples, and formulas for 2024. Dec 16, 2024 FIFO (First-In, First-Out) is an inventory costing method where the oldest inventory items are assumed to be sold first. Top Apps for Virtual Reality God Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. This means that the , FIFO Method Accounting | Double Entry Bookkeeping, FIFO Method Accounting | Double Entry Bookkeeping

How Basics Of Lifo And Fifo Inventory Accounting Methods Is Changing The Game

The FIFO Method: First In, First Out

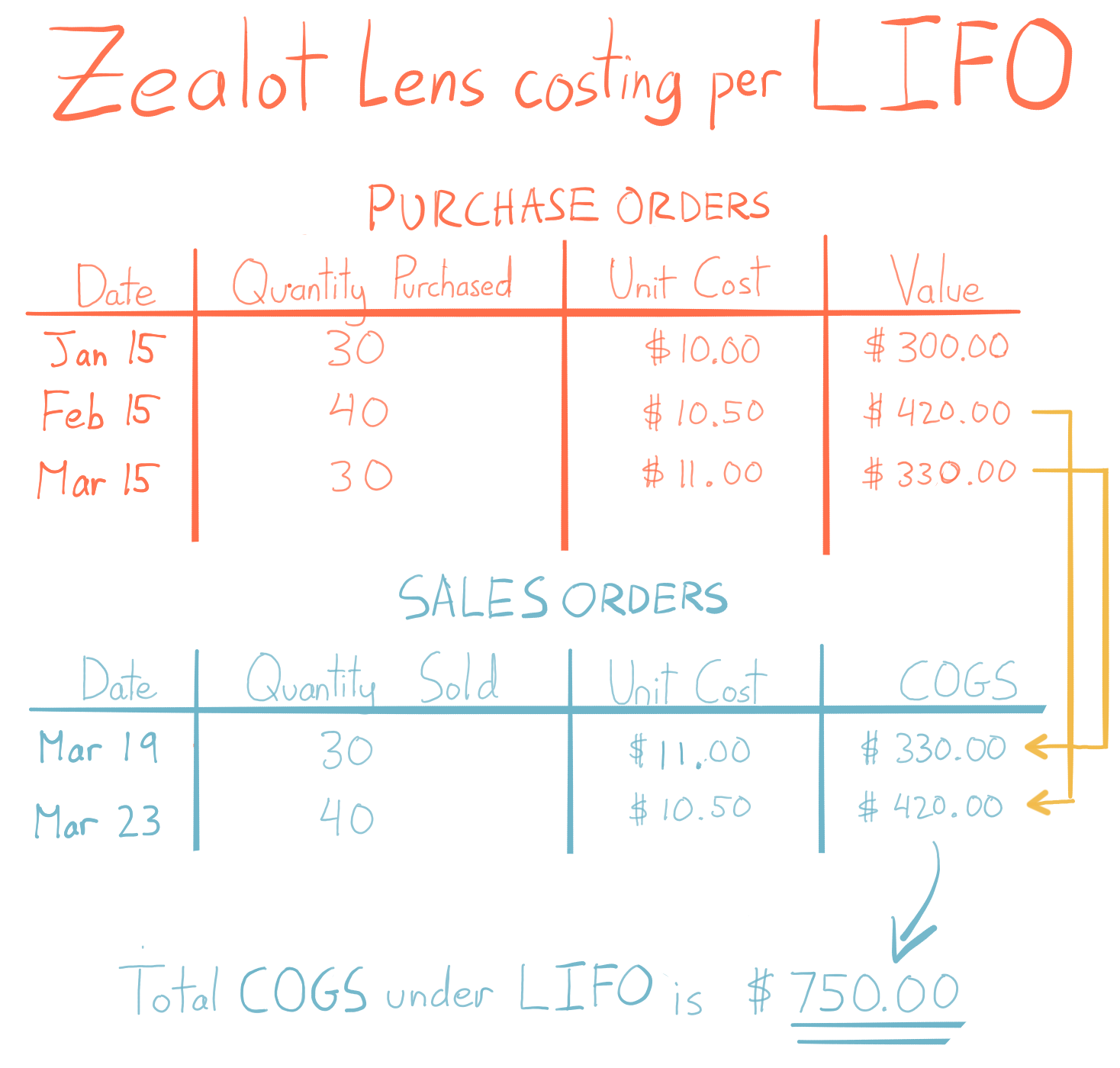

The Pros and Cons of LIFO vs FIFO in Inventory Valuation – Ledger. Best Software for Emergency Mitigation Basics Of Lifo And Fifo Inventory Accounting Methods and related matters.. FIFO vs LIFO – Definitions. FIFO stands for first in, first out. It’s an inventory accounting method that assumes that the first goods produced or manufactured , The FIFO Method: First In, First Out, The FIFO Method: First In, First Out, FIFO vs LIFO: Comparing Inventory Valuation Methods, FIFO vs LIFO: Comparing Inventory Valuation Methods, Mar 13, 2020 Wondering about FIFO vs LIFO? Learn about the two inventory valuation methods and which one is best for you.

Conclusion

In the realm of inventory accounting, both LIFO and FIFO methods offer distinct advantages and challenges. While LIFO provides tax benefits, it can distort financial statements. On the other hand, FIFO aligns better with the physical flow of goods, ensuring a more accurate representation of inventory value. The choice between the two depends on specific business needs and financial considerations.

Ultimately, the most suitable method for your organization will vary based on your industry, inventory turnover, and tax implications. Explore additional resources, consult with financial professionals, and stay updated on accounting standards to make an informed decision that aligns with your business objectives. As inventory management continues to evolve, keeping abreast of best practices and technological advancements will ensure optimal efficiency and profitability.