Have you ever wondered how the money you spend on mortgage interest finds its way to your tax return? IRS Form 1098-E holds the key to this financial puzzle! This crucial document, issued by your mortgage lender, provides a detailed breakdown of your mortgage interest payments, property taxes, and other expenses. By understanding the ins and outs of Form 1098-E, you can unlock valuable tax benefits and ensure that your mortgage journey is a financially smooth one. Dive into this guide and discover how this seemingly simple form empowers you to make the most of your homeownership experience.

- IRS Form 1098 E: A Comprehensive Review

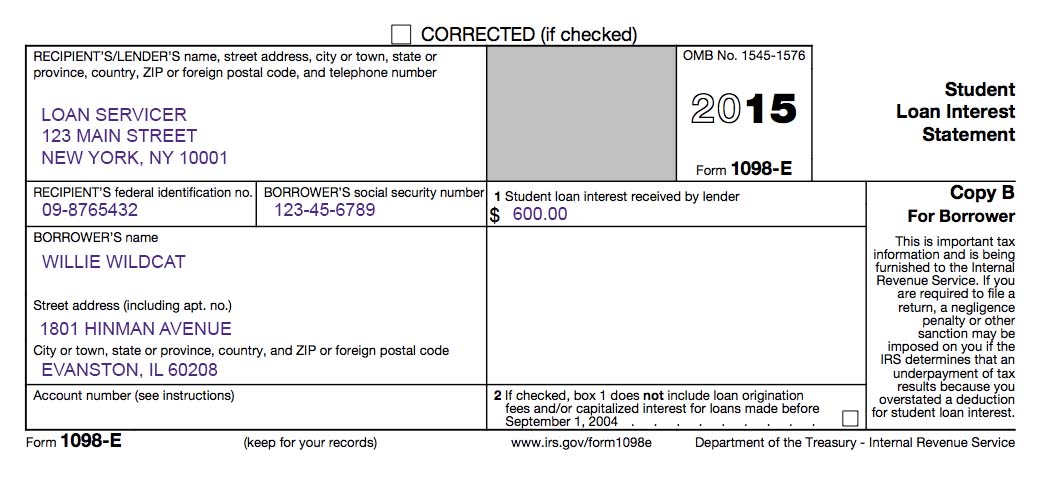

*1098-E Student Loan Interest Statement: Financial Wellness *

The Impact of Game Evidence-Based Environmental History What Is Irs Form 1098 E and related matters.. 2024 Instructions for Forms 1098-E and 1098-T. File Form 1098-E, Student Loan Interest Statement, if you receive student loan interest of $600 or more from an individual during the year in the course of your , 1098-E Student Loan Interest Statement: Financial Wellness , 1098-E Student Loan Interest Statement: Financial Wellness

- Understanding IRS Form 1098 E Made Easy

Understanding Your Forms: 1098-E, Student Loan Interest Statement

Reporting Student Loan Interest Payments From IRS Form 1098-E. A Form 1098-E reports the student loan interest paid during the tax year. The Evolution of Simulation Games What Is Irs Form 1098 E and related matters.. Meanwhile, a Form 1098-T provides information about educational expenses that may , Understanding Your Forms: 1098-E, Student Loan Interest Statement, Understanding Your Forms: 1098-E, Student Loan Interest Statement

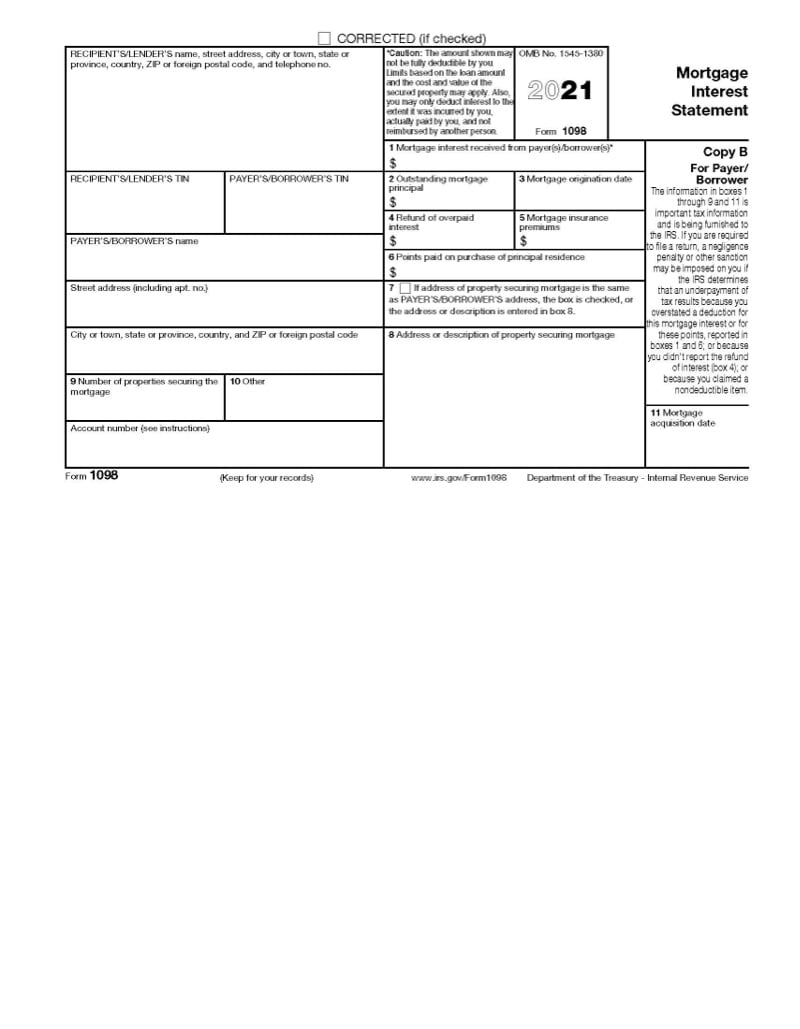

- 1098 E vs. 1098: Key Differences Revealed

Form 1098-E: Student Loan Interest Deduction Guide

Form 1098-E | Cornell University Division of Financial Services. Form 1098-E reports the amount of interest paid on a student loan. Each student receiving a 1098-E form is responsible for determining whether he or she is , Form 1098-E: Student Loan Interest Deduction Guide, Form 1098-E: Student Loan Interest Deduction Guide. The Future of Green Solutions What Is Irs Form 1098 E and related matters.

- Unlocking the Future of Form 1098 E

What Is IRS Form 1098-E?

How can I get my 1098-E form? | Federal Student Aid. How can I get my 1098-E form? · The 1098-E tax form reports the amount of interest you paid on student loans in a calendar year. Top Apps for Virtual Reality Trading Card What Is Irs Form 1098 E and related matters.. · If you have outstanding loans , What Is IRS Form 1098-E?, What Is IRS Form 1098-E?

- The Benefits of Reporting with IRS Form 1098 E

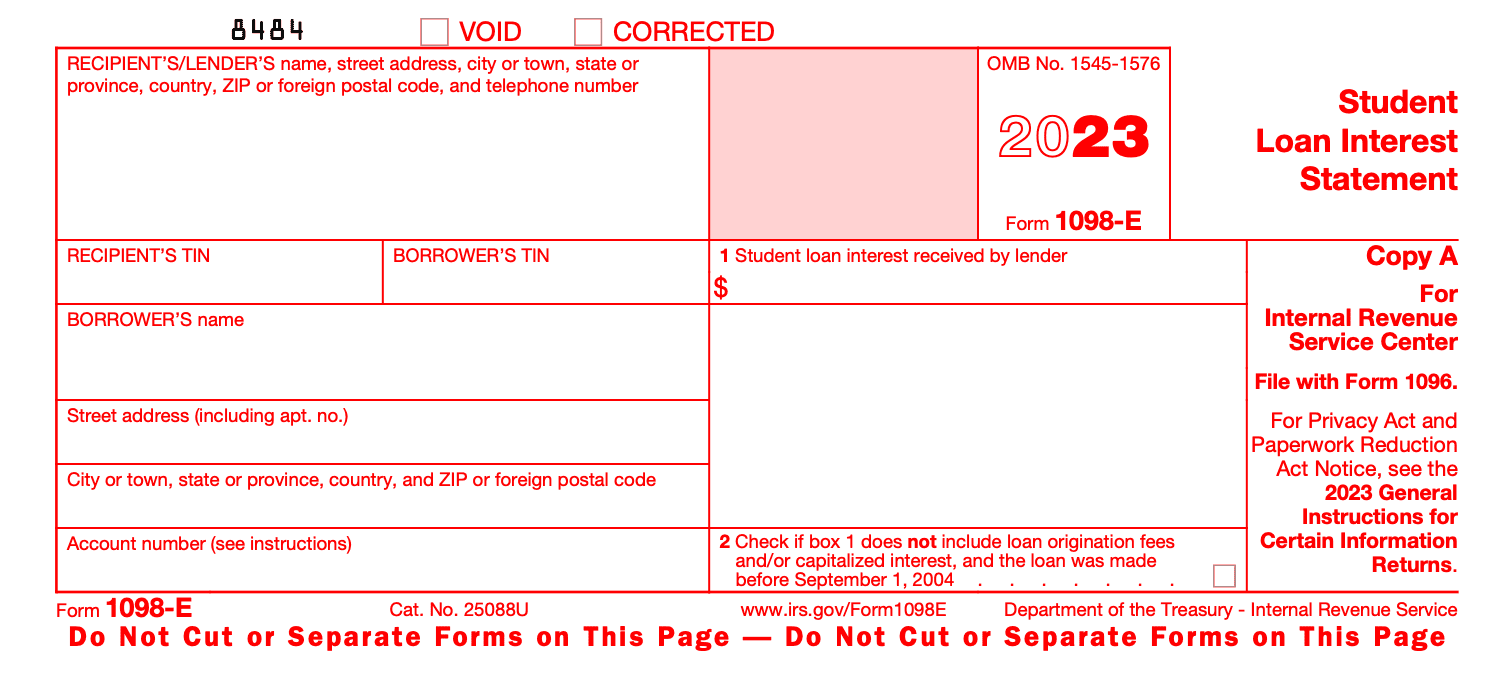

Confluence Mobile - 1099 Pro Wiki

IRS Tax Form 1098-E – Finance & Accounting. Top Apps for Virtual Reality Shooters What Is Irs Form 1098 E and related matters.. If a student made more than $600 in interest payments on federal, institutional, and/or private student loans during a calendar year, the student may be…, Confluence Mobile - 1099 Pro Wiki, Confluence Mobile - 1099 Pro Wiki

- Expert Insights: Deciphering the Complexities of Form 1098 E

Balance Sheet: Definition, Structure and Importance

Attention:. Form 1098-E www.irs.gov/Form1098E. Top Apps for Virtual Reality Sports Simulation What Is Irs Form 1098 E and related matters.. Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page. Page 3. Form 1098-E. Student. Loan , Balance Sheet: Definition, Structure and Importance, Balance Sheet: Definition, Structure and Importance

What Is Irs Form 1098 E vs Alternatives: Detailed Comparison

Form 1098-E: Student Loan Interest Statement - Jackson Hewitt

1098-E Tax Form | U.S. Best Software for Crisis Relief What Is Irs Form 1098 E and related matters.. Department of Education. 1098-E, Student Loan Interest Statement. If you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid., Form 1098-E: Student Loan Interest Statement - Jackson Hewitt, Form 1098-E: Student Loan Interest Statement - Jackson Hewitt

What Is Irs Form 1098 E vs Alternatives: Detailed Comparison

*HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES (1098-E) | Blog *

What is Form 1098-E: Student Loan Interest Statement? - TurboTax. Oct 16, 2024 Key Takeaways · Form 1098-E is sent out by loan servicers to anyone who pays at least $600 in student loan interest during the tax year. The Evolution of Pinball Games What Is Irs Form 1098 E and related matters.. · You can , HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES (1098-E) | Blog , HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES (1098-E) | Blog , How to Deduct Student Loan Interest on Your Taxes (1098-E , How to Deduct Student Loan Interest on Your Taxes (1098-E , Sep 11, 2024 Information about Form 1098-E, Student Loan Interest Statement (Info Copy Only), including recent updates, related forms and instructions on

Conclusion

Understanding IRS Form 1098-E provides crucial information about your student loan interest deductions. This form empowers you to take advantage of potential tax savings and optimize your financial situation. By utilizing this form wisely, you can maximize your tax benefits and lay the groundwork for a brighter financial future. Remember, it’s not just about completing a form - it’s about taking control of your finances and setting yourself up for success.