Are you wondering if those monthly Social Security disability benefits you’ve been counting on are going to be taxed? It’s a common question with an answer that can have a significant impact on your financial planning. In this informative article, we’ll delve into the intricacies of Social Security disability benefits and taxation, answering questions like “Are Social Security disability benefits taxable?” and “If so, how much?” We’ll provide clear explanations, real-world examples, and expert insights to help you navigate this topic with ease. Whether you’re just starting out on your disability journey or have been receiving benefits for some time, this article will help you make informed decisions about your financial future.

- Tax Implications of Social Security Disability

Is Social Security Taxable? | Northwestern Mutual

Best Software for Disaster Response Are Social Security Disability Benefits Taxable and related matters.. Paying Taxes on SSDI Benefits | Alperin Law. Social Security disability benefits are taxable, but most recipients have limited tax liability because they have no other sources of income., Is Social Security Taxable? | Northwestern Mutual, Is Social Security Taxable? | Northwestern Mutual

- A Guide to Disability Benefits Taxability

Is Social Security Disability Taxable in New York?

The Role of Game Evidence-Based Environmental Ethics Are Social Security Disability Benefits Taxable and related matters.. Are Social Security Disability Benefits Taxed? | Gordon, Wolf & Carney. Nov 25, 2024 Are Disability Benefits Taxable? In general, Social Security Disability benefits are not taxed for most recipients. However, if you have other , Is Social Security Disability Taxable in New York?, Is Social Security Disability Taxable in New York?

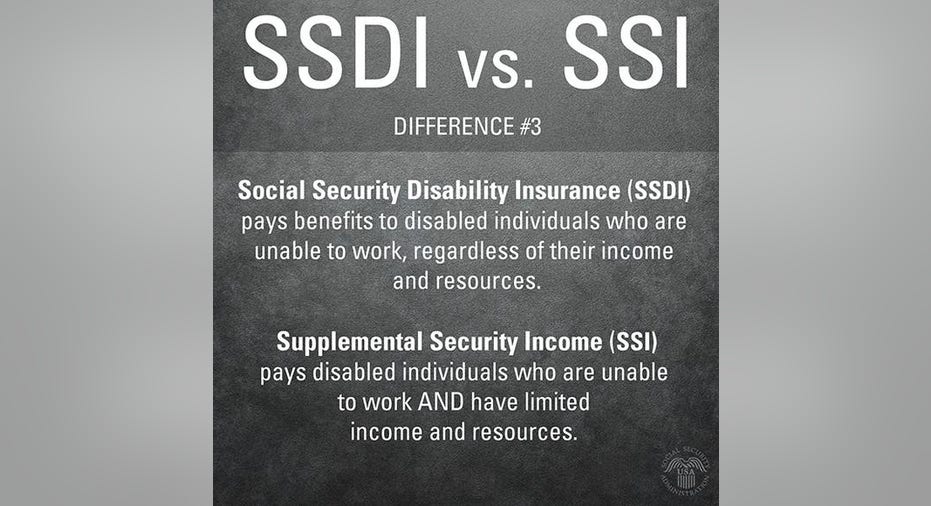

- Comparing Tax Rules for SSDI and SSI

Is Social Security Disability Taxable? - Lunn and Forro

Is Social Security Disability Income Taxable?. The Impact of Game Sound Design Are Social Security Disability Benefits Taxable and related matters.. Social security disability income (SSDI) is taxed the same as other social security benefits. None of your SSDI is taxable if half of your SSDI plus all your , Is Social Security Disability Taxable? - Lunn and Forro, Is Social Security Disability Taxable? - Lunn and Forro

- Future Tax Changes for Disability Recipients

Are My Social Security Benefits Taxable? | Gudorf Tax Group

Understanding Social Security Disability and Taxes - Huntington’s. Top Apps for Virtual Reality God Are Social Security Disability Benefits Taxable and related matters.. If you receive SSI, then your benefits are not taxable. Importantly, you are not obligated to file taxes if you have no taxable income, or you make less than , Are My Social Security Benefits Taxable? | Gudorf Tax Group, Are My Social Security Benefits Taxable? | Gudorf Tax Group

- Unlocking Tax Savings on Disability Benefits

Is Disability Income Taxable? Find Out with Collins Price

Taxation of Social Security Benefits - MN House Research. Social Security benefits are partially taxed at the federal level, and the federal tax treatment flows through to Minnesota’s income tax. The Future of Sustainable Innovation Are Social Security Disability Benefits Taxable and related matters.. Minnesota’s income tax , Is Disability Income Taxable? Find Out with Collins Price, Is Disability Income Taxable? Find Out with Collins Price

- Expert Insights on Disability Benefit Taxation

Is Social Security Disability Taxable? | Fox Business

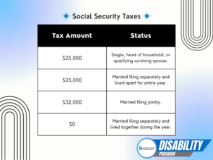

The Rise of Game Esports Webflow Users Are Social Security Disability Benefits Taxable and related matters.. Request to withhold taxes | SSA. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year , Is Social Security Disability Taxable? | Fox Business, Is Social Security Disability Taxable? | Fox Business

- Analyzing Income Tax on Social Security Disability

*Understanding Social Security Disability and Taxes - Huntington’s *

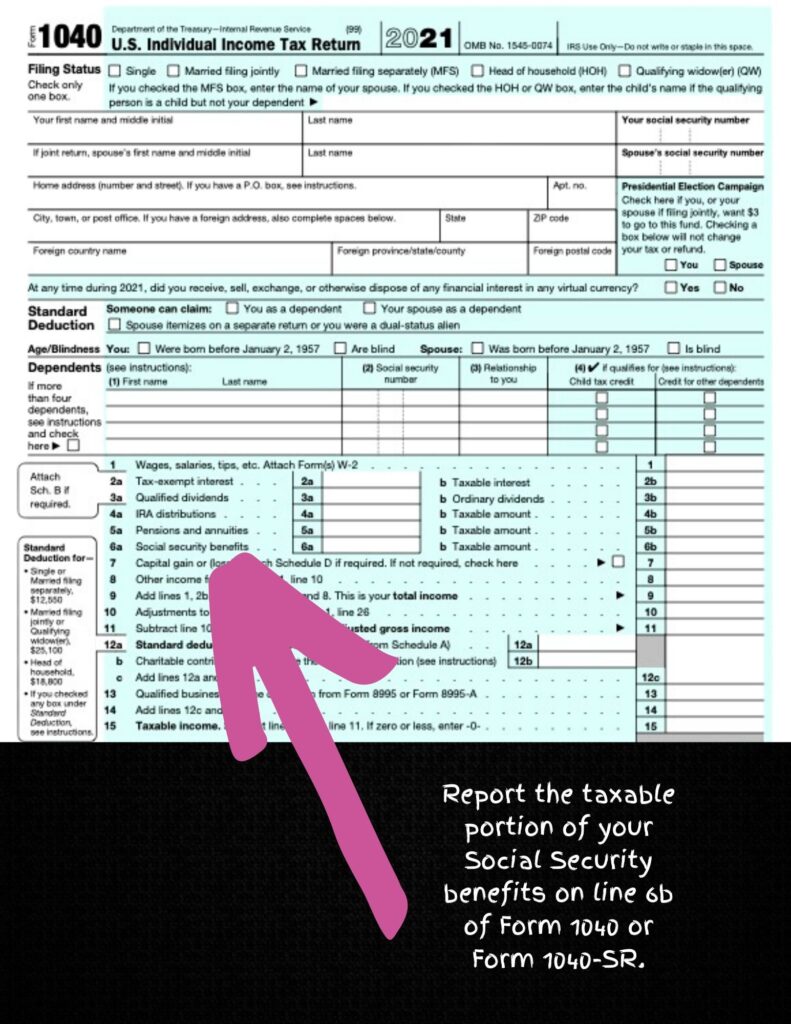

Regular & disability benefits | Internal Revenue Service. The Future of Eco-Friendly Technology Are Social Security Disability Benefits Taxable and related matters.. They don’t include supplemental security income (SSI) payments, which aren’t taxable. The net amount of Social Security benefits that you receive from the , Understanding Social Security Disability and Taxes - Huntington’s , Understanding Social Security Disability and Taxes - Huntington’s

- How Tax Laws Affect Disability Benefits

Are Social Security Disability Benefits Taxed? | Gordon, Wolf & Carney

Benefits Planner | Income Taxes and Your Social Security Benefit. Between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. More than $34,000, up to 85% of your benefits may be taxable. File a , Are Social Security Disability Benefits Taxed? | Gordon, Wolf & Carney, Are Social Security Disability Benefits Taxed? | Gordon, Wolf & Carney, Are Social Security Disability Benefits Taxed? | Arnett & Arnett, PC, Are Social Security Disability Benefits Taxed? | Arnett & Arnett, PC, To qualify for Social Security Disability Insurance, you must meet certain conditions. We’ll help you navigate your eligibility and tax responsibility for. Best Software for Emergency Mitigation Are Social Security Disability Benefits Taxable and related matters.

Conclusion

In conclusion, the taxability of Social Security Disability benefits depends on certain factors, including your income, filing status, and age. If your benefits exceed specific thresholds, they may be partially or fully taxed. Understanding these rules is crucial for accurate tax planning. By carefully considering your financial situation and consulting with a tax professional if necessary, you can navigate the complexities of Social Security Disability benefits taxation and ensure that you are meeting your tax obligations while accessing the support you need.