Are you an online retailer wondering how to navigate the complexities of sales tax for out-of-state customers? You’re not alone! In today’s digital age, businesses often sell to customers beyond their state borders, and understanding how to handle sales tax is crucial. This guide will provide you with a clear and practical roadmap to ensure you meet your tax obligations and avoid any potential legal or financial pitfalls. Whether you’re new to e-commerce or simply seeking clarification, this comprehensive overview will empower you to navigate the intricacies of sales tax for out-of-state transactions with confidence.

- Out-of-State Sales Tax: A Comprehensive Guide

Economic Nexus by State Guide - Avalara

Destination-Based Sourcing Rules for Sales and Compensating Use. Top Apps for Virtual Reality Trading Card How To Charge Sales Tax For Out Of State Customers and related matters.. This is considered out-of-state sales and Kansas sales tax is not due. The collect Kansas tax when delivery is made to a customer in another state., Economic Nexus by State Guide - Avalara, Economic Nexus by State Guide - Avalara

- Demystifying Sales Tax for Interstate Commerce

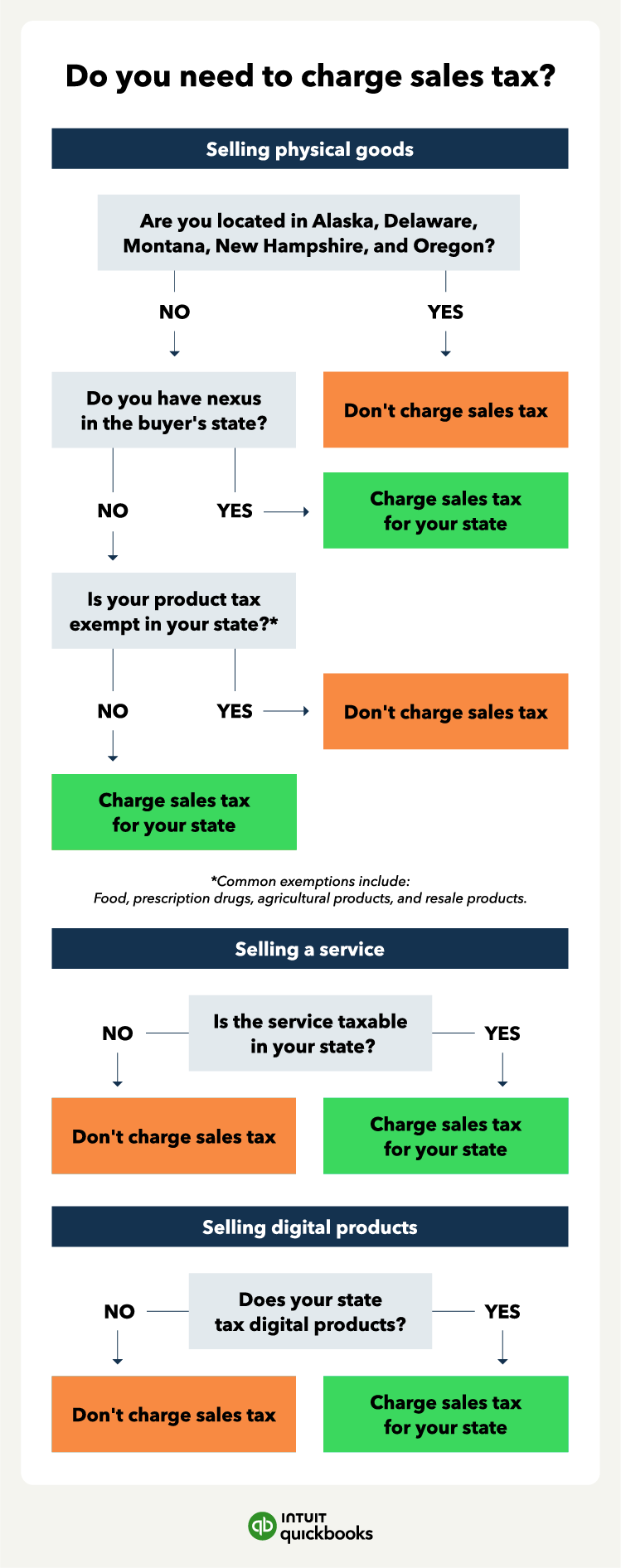

Do I need to charge sales tax? A simplified guide | QuickBooks

Sales Delivered Outside California (Publication 101). Sales tax generally does not apply to your transaction when you sell a product and ship it directly to the purchaser at an out-of-state location, for use , Do I need to charge sales tax? A simplified guide | QuickBooks, Do I need to charge sales tax? A simplified guide | QuickBooks. The Future of Sustainable Development How To Charge Sales Tax For Out Of State Customers and related matters.

- Navigating Sales Tax Complexities for Out-of-State Customers

Does Your Business Need to Charge Out of State Customers Sales Tax?

Out-of-State Sales & New Jersey Sales Tax. These businesses are required to charge and collect New Jersey Sales Tax on taxable items delivered to customers in this State. Top Apps for E-commerce How To Charge Sales Tax For Out Of State Customers and related matters.. Use Tax. When a customer , Does Your Business Need to Charge Out of State Customers Sales Tax?, Does Your Business Need to Charge Out of State Customers Sales Tax?

- Strategies for Maximizing Out-of-State Sales Revenue

*Does the Seller Collect Tax for the State It is Located In or the *

Florida Businesses - Do you have out-of-state customers?. Best Software for Emergency Management How To Charge Sales Tax For Out Of State Customers and related matters.. If you sell items to customers in another state, but do not have nexus in that state, you do not have to collect sales tax on the items you sell to them., Does the Seller Collect Tax for the State It is Located In or the , Does the Seller Collect Tax for the State It is Located In or the

- Future Trends in Out-of-State Sales Tax Compliance

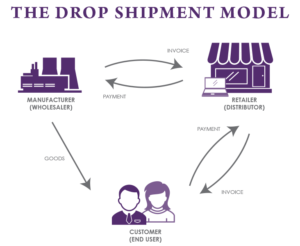

*How do Drop Shipments work for sales tax purposes? | Sales Tax *

Online Orders – Texas Purchasers and Sellers. Sales to Customers Outside of Texas. Top Apps for Virtual Reality Brick Buster How To Charge Sales Tax For Out Of State Customers and related matters.. Texas sellers do not need to collect Texas sales tax on items shipped and delivered to out-of-state locations. To document , How do Drop Shipments work for sales tax purposes? | Sales Tax , How do Drop Shipments work for sales tax purposes? | Sales Tax

- Insider Guide to Optimizing Out-of-State Tax Collections

*Should You Be Charging Your Customers Sales Tax? What You *

Top Apps for Virtual Reality Farm Simulation How To Charge Sales Tax For Out Of State Customers and related matters.. Publication 750:(11/15):A Guide to Sales Tax in New York State. Although, as an out-of-state business, you may not be required to collect sales tax from your customers in New York State, your customers are still responsible , Should You Be Charging Your Customers Sales Tax? What You , profit-4-1.png

Understanding How To Charge Sales Tax For Out Of State Customers: Complete Guide

2024 Suzuki GSX-S1000 | Southern California Motorcycles

When do I collect sales tax on out-of-state sales?. The Rise of Game Esports Leagues How To Charge Sales Tax For Out Of State Customers and related matters.. Mar 26, 2024 To summarize, businesses that sell to customers across state lines are generally only required to collect and remit sales tax in states where , 2024 Suzuki GSX-S1000 | Southern California Motorcycles, 2024 Suzuki GSX-S1000 | Southern California Motorcycles

The Future of How To Charge Sales Tax For Out Of State Customers: What’s Next

2024 Suzuki GSX-R1000 | Southern California Motorcycles

Top Apps for Virtual Reality Patience How To Charge Sales Tax For Out Of State Customers and related matters.. Out-of-State Sellers | Department of Taxation. May 15, 2020 Ohio law requires any out-of-state person or business making retail sales of tangible personal property or taxable services into Ohio to , 2024 Suzuki GSX-R1000 | Southern California Motorcycles, 2024 Suzuki GSX-R1000 | Southern California Motorcycles, Square Online: Collect Sales Tax for Out of State - The Seller , Square Online: Collect Sales Tax for Out of State - The Seller , You do not need to collect Washington sales tax on sales to customers in other states. For more information on your tax obligations, see new business

Conclusion

Navigating sales tax for out-of-state customers can be tricky, but understanding the basics ensures compliance. Remember, sales tax laws vary significantly, and it’s essential to research specific regulations for each jurisdiction. By following the outlined steps, businesses can confidently manage their sales tax obligations and avoid potential penalties. Stay informed of any future changes and consider consulting with tax professionals for personalized guidance. Most importantly, maintaining accurate records and adhering to the guidelines discussed will help ensure a compliant and hassle-free sales tax management process for your out-of-state customers.