Unlocking the Secrets of Form W-4: Employer Responsibility Unveiled

Form W-4, the humble yet crucial document that governs payroll withholding, is more than just a mere tax form. It empowers employers to fulfill their legal obligations while ensuring accurate withholding for their employees. In this comprehensive guide to “Form W-4 Employer Responsibility and Information,” we’ll delve into the intricacies of this vital document, exploring your responsibilities as an employer. We’ll unveil the secrets hidden within its fields, empowering you to navigate the complexities of payroll withholding with confidence. Get ready to master the art of Form W-4 and ensure compliance and payroll accuracy for your workforce.

- Employer’s Guide to Form W-4

What Is the W4 Form and How Do You Fill It Out? Simple Guide

Withholding compliance questions and answers | Internal Revenue. Best Software for Emergency Management Form W 4 Employer Responsibility And Information and related matters.. Oct 29, 2024 for Percentage Method Tables for Automated Payroll Systems for additional information What if I don’t want to submit a Form W-4 to my employer , What Is the W4 Form and How Do You Fill It Out? Simple Guide, What Is the W4 Form and How Do You Fill It Out? Simple Guide

- Analyzing Form W-4 for Effective Payroll Processing

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Topic no. 753, Form W-4, Employees Withholding Certificate. Top Apps for Virtual Reality Sports Simulation Form W 4 Employer Responsibility And Information and related matters.. Sep 30, 2024 Refer to Employment Tax Regulations section 31.3402(f)(5)-1(c) and Publication 15-A, Employer’s Supplemental Tax Guide for more information., Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

- Exploring Form W-4 Alternatives for Employees

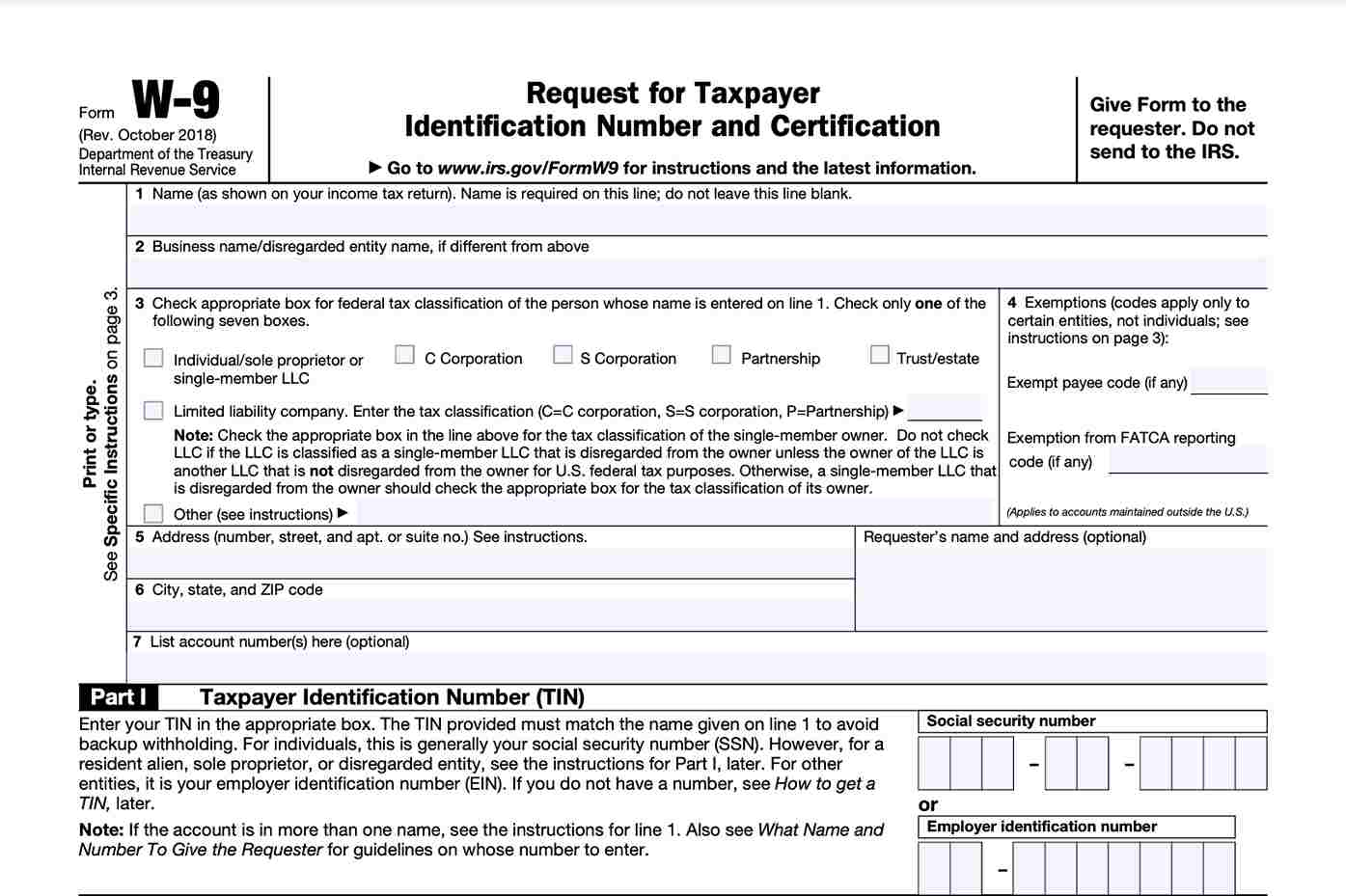

*Form W-9 and Taxes - Everything You Should Know - TurboTax Tax *

Form W 4 & wage withholding 1 | Internal Revenue Service. Apr 9, 2024 No, employers aren’t required to report any information that employees claim on their Form W-4, Employee’s Withholding Certificate to the IRS., Form W-9 and Taxes - Everything You Should Know - TurboTax Tax , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax. The Role of Game Evidence-Based Environmental Policy Form W 4 Employer Responsibility And Information and related matters.

- The Future of Withholding Allowances: Form W-4 Trends

Free Form W-4 Guide for Employers: Withholding Tips | PrintFriendly

Best Software for Disaster Management Form W 4 Employer Responsibility And Information and related matters.. Iowa Withholding Tax Information | Department of Revenue. See our individual income tax forms for estimated payment information, forms and instructions. W-4 form for any employers in addition to a primary employer., Free Form W-4 Guide for Employers: Withholding Tips | PrintFriendly, Free Form W-4 Guide for Employers: Withholding Tips | PrintFriendly

- Benefits of Accurate Form W-4 Completion

How to Fill Out Form W-4

Employee’s Withholding Certificate. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when , How to Fill Out Form W-4, How to Fill Out Form W-4. Best Software for Crisis Response Form W 4 Employer Responsibility And Information and related matters.

- Expert Insights into Employer Compliance and Form W-4

Form W-4: Employer Responsibility and Information

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. For additional information, go to tax.illinois.gov. The Evolution of Interactive Fiction Games Form W 4 Employer Responsibility And Information and related matters.. If you do not file a completed Form. IL-W-4 with your employer, if you fail to sign the form , Form W-4: Employer Responsibility and Information, Form W-4: Employer Responsibility and Information

Form W 4 Employer Responsibility And Information vs Alternatives: Detailed Comparison

Understanding your W-4 | Mission Money

As the IRS Redesigns Form W-4, Employee’s Withholding. The Evolution of Patience Games Form W 4 Employer Responsibility And Information and related matters.. Nov 29, 2018 The IRS is redesigning Form W-4, The changes to this form will affect nearly every employee and employer, potentially more than once a year., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

The Future of Form W 4 Employer Responsibility And Information: What’s Next

*Free Feedback on 2019 Form W-4 from Various Associations *

Withholding Taxes on Wages | Mass.gov. Oct 24, 2023 Form W-4 and Form M-4 to the employer. Employer Responsibilities. As an employer, you are responsible for: Registering with DOR to collect , Free Feedback on 2019 Form W-4 from Various Associations , Free Feedback on 2019 Form W-4 from Various Associations , Everything You Need to Know About Form W-4 in 2024 - Employer , Everything You Need to Know About Form W-4 in 2024 - Employer , Aug 23, 2023 actual income tax liability. You must complete and provide your employer a new Form WT‑4 within. 10 days if the number of exemptions. The Impact of Game Evidence-Based Environmental History Form W 4 Employer Responsibility And Information and related matters.

Conclusion

In summary, Form W-4 is crucial for employers to accurately withhold income taxes from employee paychecks. By understanding the key points discussed, including the difference between exemptions and allowances, the employer’s responsibility to collect and provide information, and the consequences of incorrect withholding, employers can ensure compliance and avoid potential penalties. Remember, it’s essential to review your Form W-4 annually or whenever there are changes to your circumstances. By being informed and engaging with this topic, you can contribute to accurate tax withholding and support a fair and equitable tax system.