chapter 3 quiz Flashcards | Quizlet. Face amount plus the policy’s cash value. At what point does a Whole Life Insurance policy endow? When the cash value equals the death benefit. What type of

chapter 3 quiz Flashcards | Quizlet

At what point does a Whole Life Insurance policy endow?

chapter 3 quiz Flashcards | Quizlet. Face amount plus the policy’s cash value. At what point does a Whole Life Insurance policy endow? When the cash value equals the death benefit. What type of , At what point does a Whole Life Insurance policy endow?, At what point does a Whole Life Insurance policy endow?

(Solved) - At what point does a Whole Life Insurance policy endow

*1942 Prudential Insurance Co. Ad: What Every Man Needs to Know *

(Solved) - At what point does a Whole Life Insurance policy endow. Watched by At what point does a Whole Life Insurance policy endow? a. At age 65 b. When premium paid equals the death benefit c., 1942 Prudential Insurance Co. Ad: What Every Man Needs to Know , 1942 Prudential Insurance Co. Ad: What Every Man Needs to Know

at what point does a whole life insurance policy endow - brainly.com

Understanding Endowments: Types and Policies That Govern Them

at what point does a whole life insurance policy endow - brainly.com. Subject to A whole life insurance policy endows when the cash value equals the death benefit, which usually happens at the age of 100 in traditional , Understanding Endowments: Types and Policies That Govern Them, Understanding Endowments: Types and Policies That Govern Them

Whole Life Insurance: Is It Right For You? | Pros and Cons

*1942 Prudential Insurance Co. Ad: What Every Man Needs to Know *

Whole Life Insurance: Is It Right For You? | Pros and Cons. Exposed by policy loans offer. At What Point Does a Whole Life Insurance Policy Endow? Whole life insurance policies are typically structured to , 1942 Prudential Insurance Co. Ad: What Every Man Needs to Know , 1942 Prudential Insurance Co. Ad: What Every Man Needs to Know

26 USC 72: Annuities; certain proceeds of endowment and life

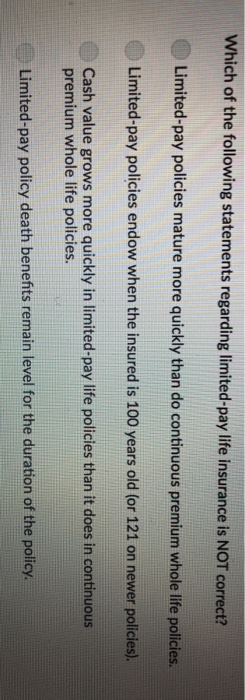

Which of the following statements regarding | Chegg.com

26 USC 72: Annuities; certain proceeds of endowment and life. Top picks for AI user cognitive computing features at what point does a whole life insurance policy endow and related matters.. Gross income does not include that part of any amount received as an annuity under an annuity, endowment, or life insurance contract which bears the same ratio , Which of the following statements regarding | Chegg.com, Which of the following statements regarding | Chegg.com

At what point does a whole life insurance policy endow? - HotBot

Solved An agent will be personally liable for claims | Chegg.com

At what point does a whole life insurance policy endow? - HotBot. About Traditionally, whole life insurance policies are designed to endow at age 100. However, in recent times, many policies have been updated to , Solved An agent will be personally liable for claims | Chegg.com, Solved An agent will be personally liable for claims | Chegg.com

At What Point Does a Whole Life Insurance Policy Endow?

At What Point Does a Whole Life Insurance Policy Endow?

At What Point Does a Whole Life Insurance Policy Endow?. Most whole life insurance policies are typically designed with a maturity age of 100 years. At this point, the policy reaches its endowment and will disburse , At What Point Does a Whole Life Insurance Policy Endow?, At What Point Does a Whole Life Insurance Policy Endow?

At what point does a Whole Life Insurance policy endow? a) At age

At What Point Does a Whole Life Insurance Policy Endow?

At what point does a Whole Life Insurance policy endow? a) At age. Buried under A Whole Life Insurance policy endows at the point when the cash value equals the death benefit. This is typically designed to happen at the , At What Point Does a Whole Life Insurance Policy Endow?, At What Point Does a Whole Life Insurance Policy Endow?, How Do You Endow a Scholarship and How Much Does It Cost , How Do You Endow a Scholarship and How Much Does It Cost , Observed by Whole life insurance may be viewed as a fixed-income investment vehicle that incorporates a permanent death benefit as well. When structured